ARTICLE ORIGINALLY POSTED ON MUD BY JIE YEE ONG – Source: Makeuseof.com Technology Explained

You cannot mine Bitcoin with your CPU. For that, you’ll need an ASIC miner. Here’s why.

Bitcoin does not appear out of thin air. Cryptocurrency may be a digital entity made out of zeros and ones, but a lot of behind-the-scenes hardware work actually takes place when it comes to producing them.

To obtain a single Bitcoin, you have to mine for them using specialized hardware, known as an ASIC miner.

ASIC Mining and Blockchain

Before you get into ASIC mining, you first need to understand blockchain technology. In very simple terms, blockchain is a technology that generates a hash that is not repeatable or replaceable.

These hashes are then cryptographically linked and “stacked” on one another (hence “block”) to ensure that nothing is repeated, creating a chain (hence “chain”) of codes that guarantee uniqueness and security. Our article on how blockchain technology works explains the entire process in more detail.

All cryptocurrencies, including NFTs and Bitcoins, are built on blockchain technology. So, “mining” for cryptos actually refers to creating blocks and blocks of codes. Therefore, creating blockchains means mining for cryptos, and for that, you need ASIC miners.

Where and When Did ASIC Mining Originate?

ASIC stands for “Application-Specific Integrated Circuit miner.” It is basically a very powerful, high-performance hardware that is designed to mine for cryptocurrency.

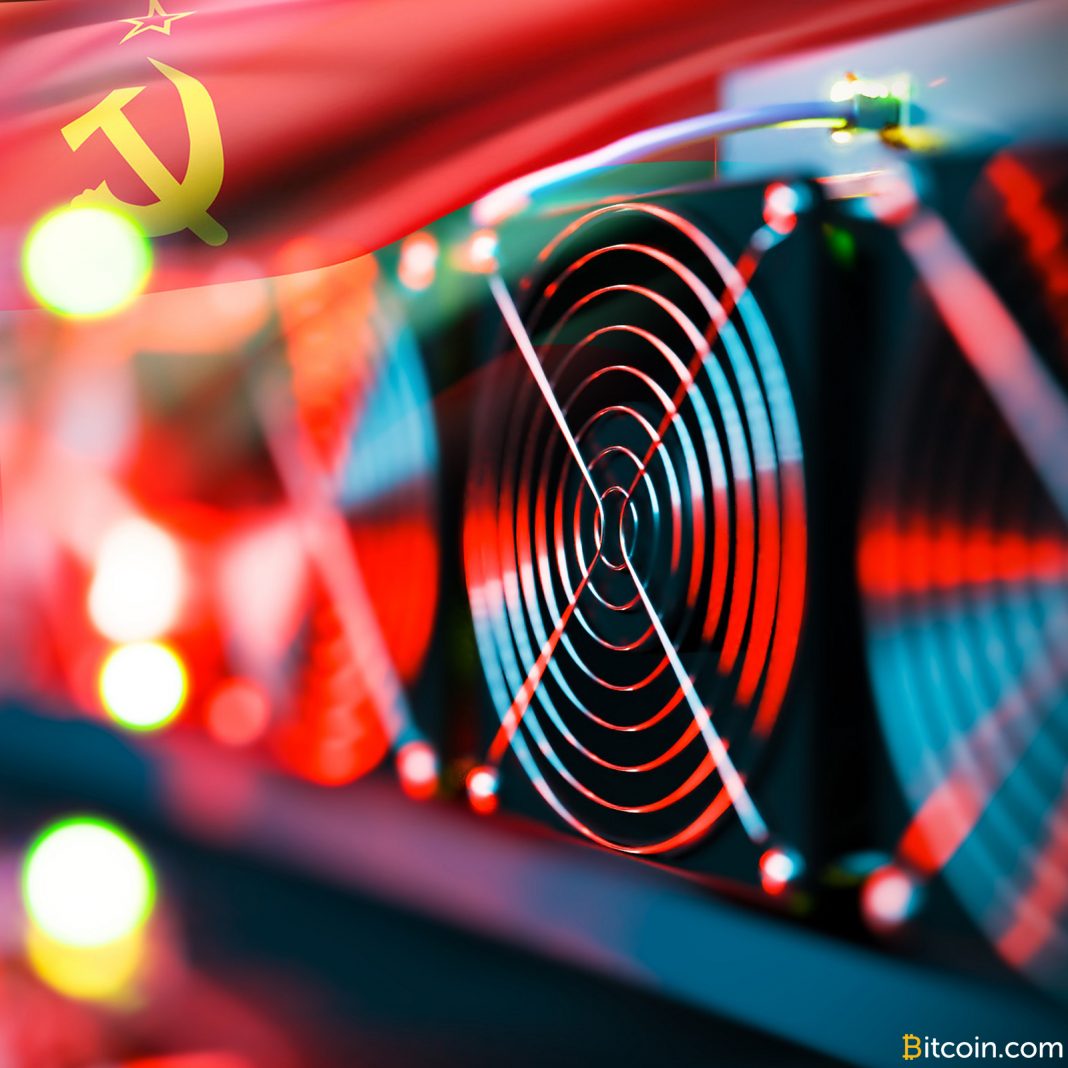

The practice of ASIC mining began in 2013, when Chinese hardware company, Canaan Creative, manufactured the first ASIC miner of its kind.

It takes a lot of computational power to mine Bitcoin, so much that traditional CPUs and GPUs were no longer able to do so competitively, hence the need for a new type of hardware that could handle the demands of crypto mining.

Soon after Canaan Creative, companies such as Bitman, Bitwats, and MicroBT started manufacturing ASIC miners.

An ASIC miner typically comprises a few important components: an ASIC chip that runs calculations for codes, a cooling fan, and a backup generator to protect against power disruptions during the mining process.

Technically, anyone can be involved in ASIC mining. If you are an individual looking to mine in exchange for money from the comfort of your own home, you will need to purchase an ASIC miner.

However, this equipment is not cheap. ASIC miners can range anywhere from $200 to over $15,000. Because of this, miners collaborate in “mining pools,” where a group of miners works together to mine for cryptocurrency, pooling the resources of their ASIC miners.

Profits from the activity are then split amongst the group, usually divided by work and energy.

Advantages and Disadvantages of ASIC Mining

Advantages and Disadvantages of ASIC Mining

The most obvious advantage of ASIC miners is the machine’s efficiency.

ASIC miners are much faster at solving the series of mathematical puzzles required for Bitcoin mining in ten minutes or less (the average time between blocks on the Bitcoin blockchain) when compared to a CPU.

When a puzzle is solved, the programmer behind the screen earns a block reward, which currently stands at 6.25 BTC. Therefore, this high efficiency translates to better money-making potential.

However, the high computational power of ASIC miners also means environmental destruction due to colossal energy consumption. Official estimates vary, but the Bitcoin mining network uses over 120 Terawatt-hours of energy per year, consuming around 0.6 percent of the global energy supply, or the equivalent to the entire energy consumption of Argentina or Norway.

Some people turn to the smaller, less energy-hungry Raspberry Pi to mine for cryptocurrencies in response to this. If the cost of electricity is so high, is it really worth it to mine for cryptos?

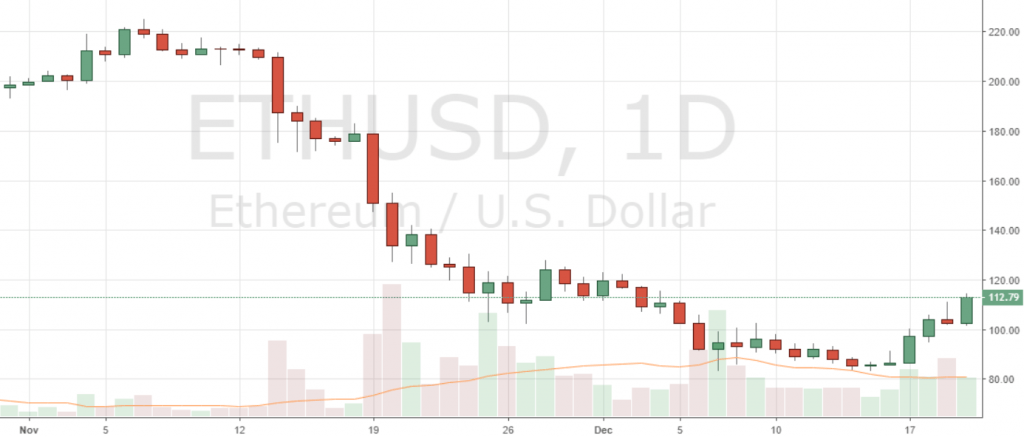

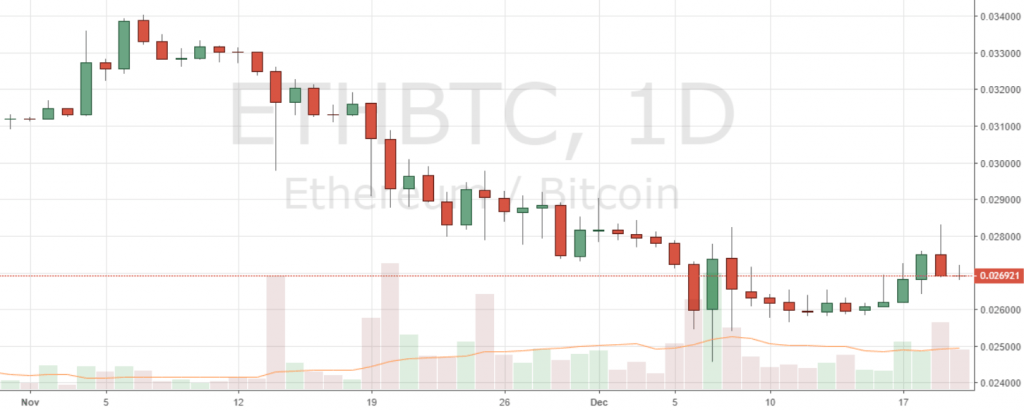

It all depends on the kind of crypto you mine for—if it is a mainstream cryptocurrency such as Bitcoin or Ethereum, you may be in for bigger rewards, but it is harder to get your hands on the rewards in the first place.

If it is niche crypto, it may take longer to turn a profit. Energy consumption caused by ASIC mining varies according to location, but regardless, its environmental impact cannot be ignored.

The Biggest ASIC Mining Companies

The biggest publicly traded cryptocurrency mining companies are based in the US and Europe. They include Riot Blockchain, Hive Blockchain, and Northern Data AG. The former two are listed on the Nasdaq stock exchange, whereas Northern Data AG is listed on Xetra, a German stock exchange market.

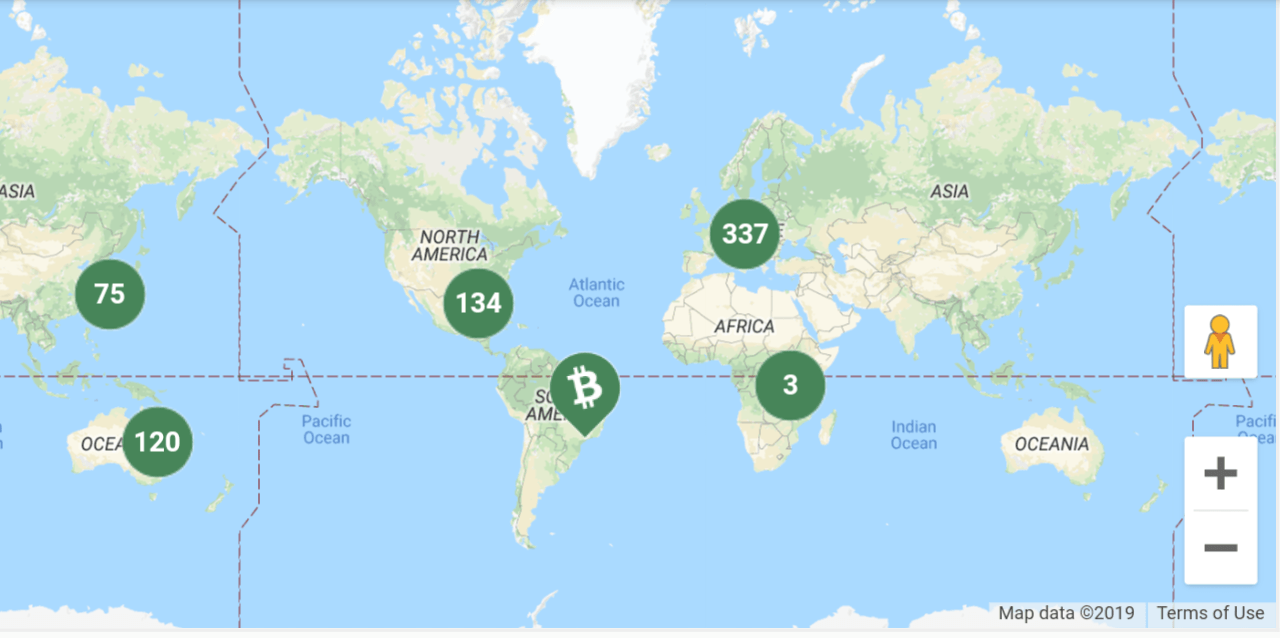

Besides these companies, several locations across the globe are known as “bitcoin farms.”

These are places where huge warehouses are built, and large numbers of ASIC miners are hauled inside to mine Bitcoin and other cryptocurrencies 24/7.

The largest bitcoin farms include Reykjavik, Amsterdam, Texas, Moscow, and the Liaoning Province in Northeast China (although many Bitcoin mining operations in Northern China are relocating due to environmental rules introduced in 2021).

Is ASIC Mining Worthwhile?

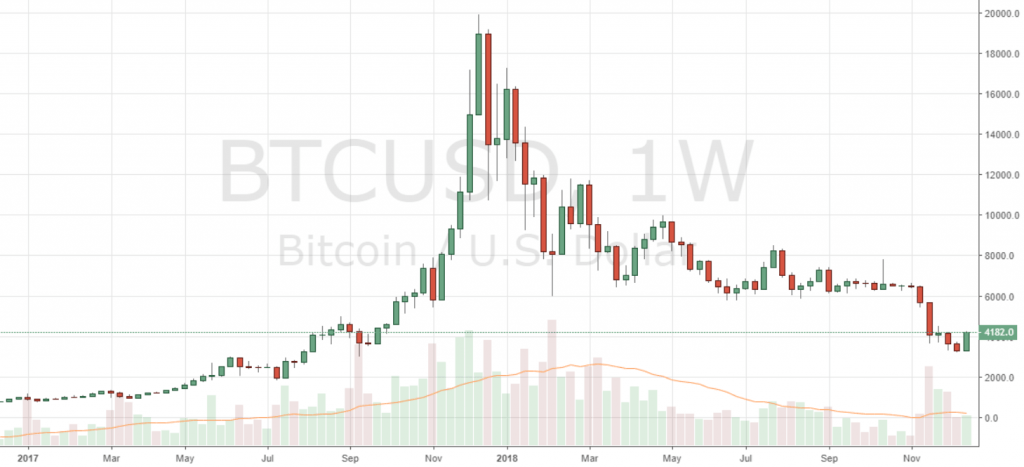

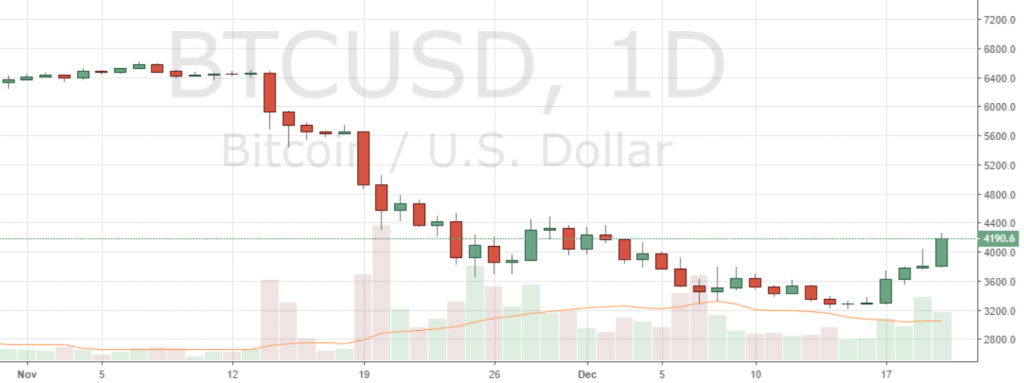

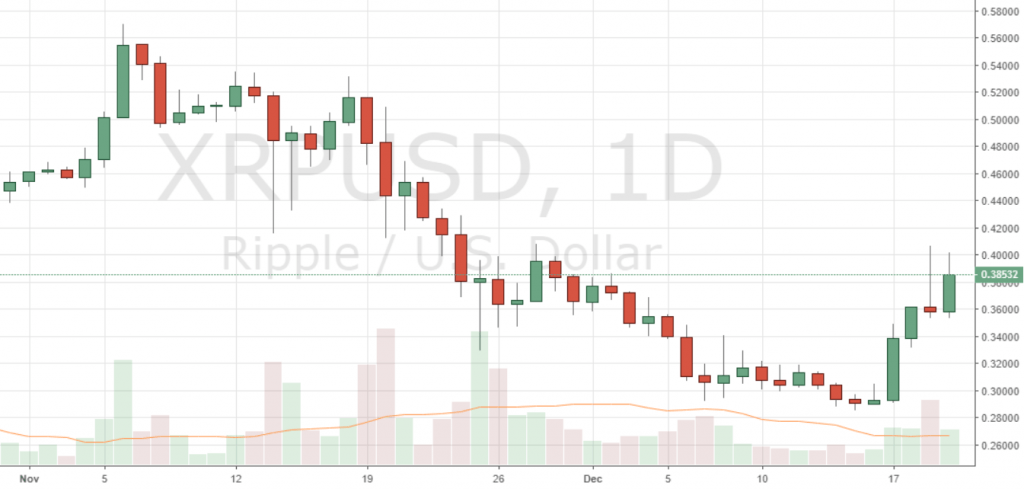

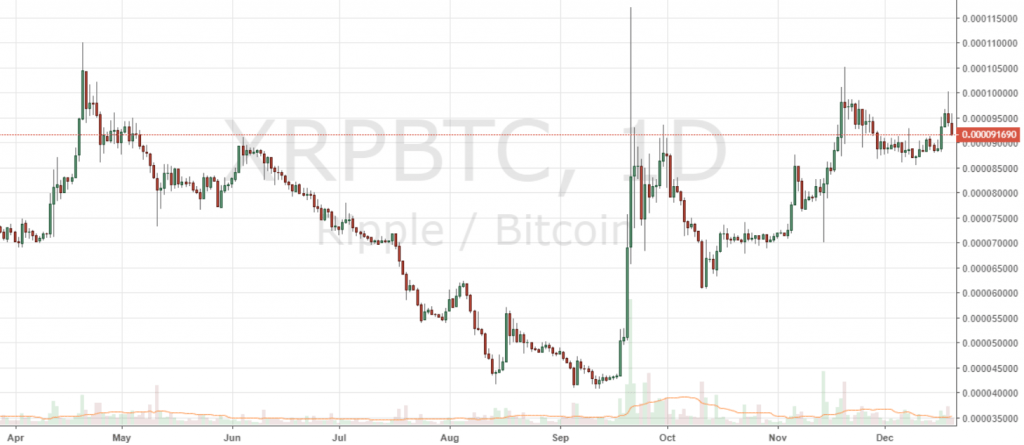

Thanks to surging cryptocurrency investments, ASIC mining is a booming industry, and it seems like the fever is not going away anytime soon. If you’re thinking of investing in an ASIC miner or starting a mining group with your mates, do plenty of research beforehand. After all, like many investments, crypto is still a volatile market.

Advantages and Disadvantages of ASIC Mining

Advantages and Disadvantages of ASIC Mining

Wagner said: “The nature of the crypto market being fast-moving and volatile in comparison to the traditional market has led to it attracting a measure of concern. Making accurate predictions on prices in the cryptocurrency market is difficult. This is combined with the fact that derivatives themselves have a poor reputation.”

Wagner said: “The nature of the crypto market being fast-moving and volatile in comparison to the traditional market has led to it attracting a measure of concern. Making accurate predictions on prices in the cryptocurrency market is difficult. This is combined with the fact that derivatives themselves have a poor reputation.”

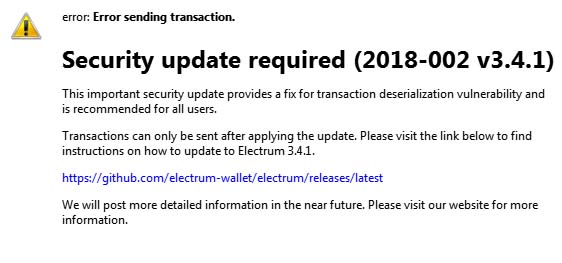

Users of the Electrum bitcoin wallet have been targeted in a new phishing attack, the project’s developers

Users of the Electrum bitcoin wallet have been targeted in a new phishing attack, the project’s developers

Huobi Derivative Market’s daily volume has exceeded $1 billion within a month after the launch of the trading service, the Singapore-based cryptocurrency exchange announced. The threshold was reached on Dec. 25, which was also a strong day for the company’s main trading platform, Huobi Global, with the combined trading volume of both Huboi’s platforms amounting to $2 billion on Christmas day. Huobi Global CEO Livio Weng commented:

Huobi Derivative Market’s daily volume has exceeded $1 billion within a month after the launch of the trading service, the Singapore-based cryptocurrency exchange announced. The threshold was reached on Dec. 25, which was also a strong day for the company’s main trading platform, Huobi Global, with the combined trading volume of both Huboi’s platforms amounting to $2 billion on Christmas day. Huobi Global CEO Livio Weng commented: Gustavo Schiavon, one of the founders of the leading Brazilian cryptocurrency exchange Foxbit, has died in a road accident. While driving between Marília and São Paulo, the young entrepreneur reportedly lost control over his car and ran into a cargo truck. Gustavo’s girlfriend, Ariadny Rinolfi, has survived but has been hospitalized in serious condition. Another victim died in the crash that involved a total of two passenger cars and two large trucks.

Gustavo Schiavon, one of the founders of the leading Brazilian cryptocurrency exchange Foxbit, has died in a road accident. While driving between Marília and São Paulo, the young entrepreneur reportedly lost control over his car and ran into a cargo truck. Gustavo’s girlfriend, Ariadny Rinolfi, has survived but has been hospitalized in serious condition. Another victim died in the crash that involved a total of two passenger cars and two large trucks.

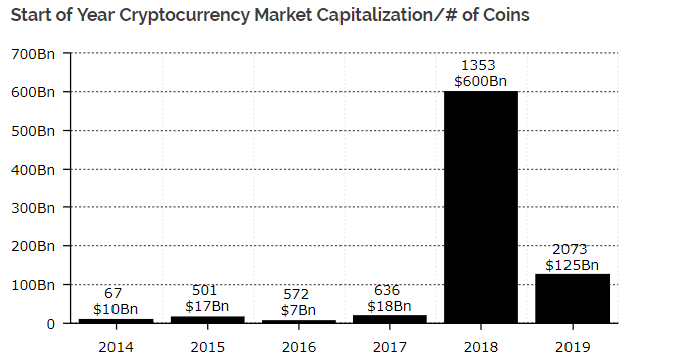

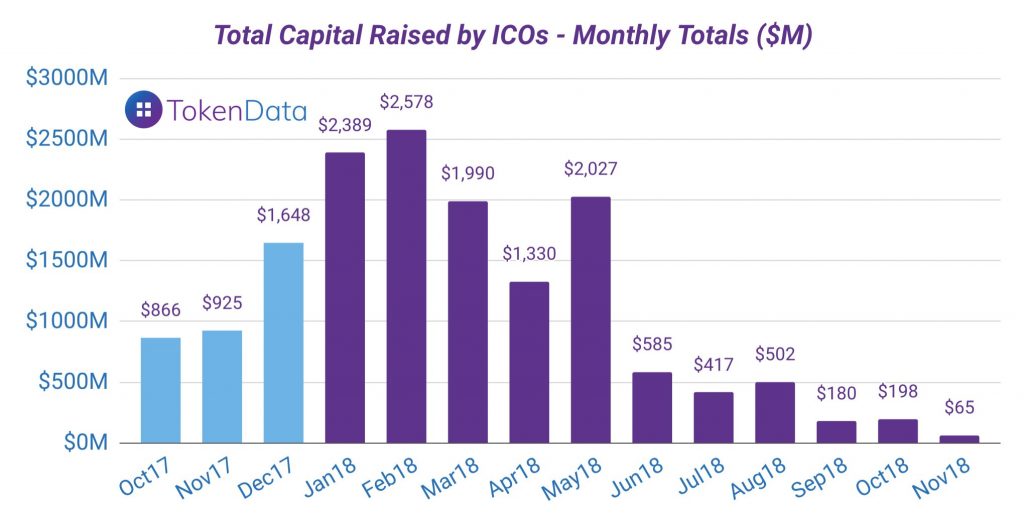

This time last year, all kinds of bold predictions were being issued for what 2018 would hold for the crypto space. In the event, the biggest trend of the year was one which few futurologists foresaw – stablecoins. 2018 will go down as the year the markets went south and ICOs died off, leaving a new wave of digital assets to shine – dollar-pegged stablecoins.

This time last year, all kinds of bold predictions were being issued for what 2018 would hold for the crypto space. In the event, the biggest trend of the year was one which few futurologists foresaw – stablecoins. 2018 will go down as the year the markets went south and ICOs died off, leaving a new wave of digital assets to shine – dollar-pegged stablecoins. With the Mimblewimble-powered

With the Mimblewimble-powered

While security token projects are poised to launch in proactive territories like Malta and Gibraltar, where regulatory frameworks have been drawn up, slower progress is expected in the U.S., where fundraising options are limited. There, the SEC will likely deem most ICOs to be issuing securities. American crypto-based projects are no closer to being granted Reg A+ approval to launch an STO, despite some, such as Gab, having filed the paperwork over a year ago.

While security token projects are poised to launch in proactive territories like Malta and Gibraltar, where regulatory frameworks have been drawn up, slower progress is expected in the U.S., where fundraising options are limited. There, the SEC will likely deem most ICOs to be issuing securities. American crypto-based projects are no closer to being granted Reg A+ approval to launch an STO, despite some, such as Gab, having filed the paperwork over a year ago. Crypto debt markets and credit networks will be bolstered by the growth of projects like

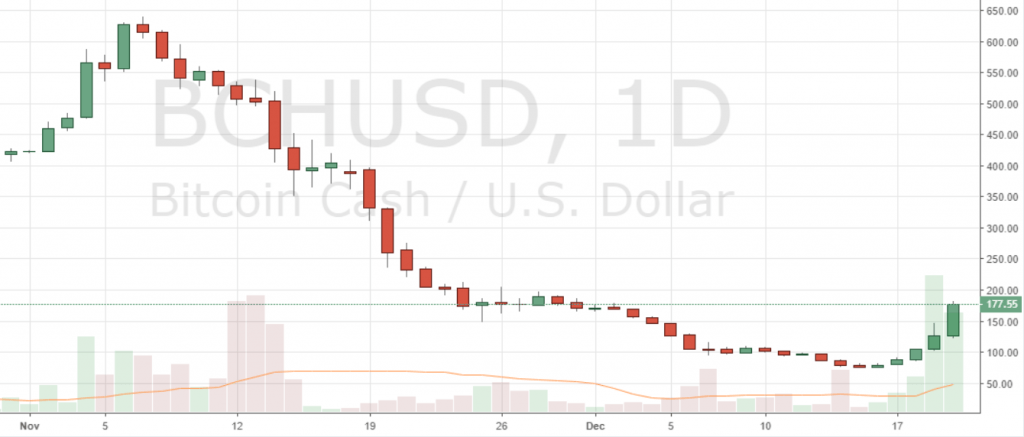

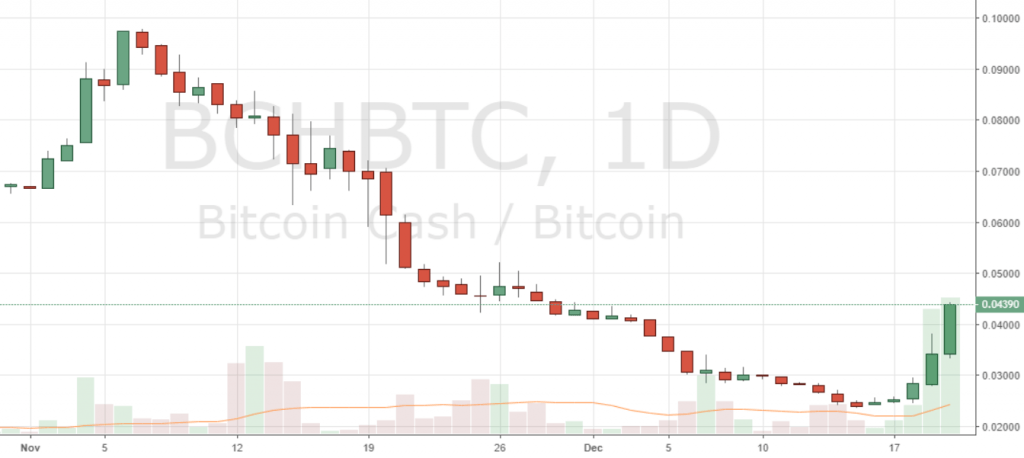

Crypto debt markets and credit networks will be bolstered by the growth of projects like  The Bitcoin Cash community will continue to find new ways to spend and receive peer-to-peer cash, while the BTC brigade will have optimism that 2019 will finally be the year when the Lightning Network proves its suitability for something more than purchasing stickers. Custodial services for institutional investors will improve, bringing new money into the crypto space (but probably not propelling crypto assets to new highs). NYSE’s Bakkt will launch, bringing physical BTC futures contracts, and there’s an outside bet the SEC might approve a bitcoin ETF.

The Bitcoin Cash community will continue to find new ways to spend and receive peer-to-peer cash, while the BTC brigade will have optimism that 2019 will finally be the year when the Lightning Network proves its suitability for something more than purchasing stickers. Custodial services for institutional investors will improve, bringing new money into the crypto space (but probably not propelling crypto assets to new highs). NYSE’s Bakkt will launch, bringing physical BTC futures contracts, and there’s an outside bet the SEC might approve a bitcoin ETF.

Open Finance Network (OFN), a security token trading platform regulated in the U.S., announced it’s transitioning from beta to full trading functionality. According to a blog post on Medium, one of the security tokens available to trade at launch is Blockchain Capital (BCAP). Blockchain Capital is a tokenized venture capital fund focused on digital assets. OFN notes that this is a compliant security token offering.

Open Finance Network (OFN), a security token trading platform regulated in the U.S., announced it’s transitioning from beta to full trading functionality. According to a blog post on Medium, one of the security tokens available to trade at launch is Blockchain Capital (BCAP). Blockchain Capital is a tokenized venture capital fund focused on digital assets. OFN notes that this is a compliant security token offering. Digital asset exchange and crypto wallet provider

Digital asset exchange and crypto wallet provider

Earlier this year, the Pridnestrovian Moldavian Republic (

Earlier this year, the Pridnestrovian Moldavian Republic ( The largest producer of electricity in the region is the Russian-owned

The largest producer of electricity in the region is the Russian-owned