Cryptocurrency is a digital based medium of exchange that uses cryptographic functions to conduct financial transactions. Through blockchain technology, it achieves decentralization, transparency, and immutability. Simplified, cryptocurrency can be compared to casino chips or arcade tokens. It’s a form of payment, like the U.S. dollar and can be used to buy goods and services. But, unlike fiat money, it’s digital and uses encryption techniques to control the creation of monetary units and to verify funds that are transferred. Unique to cryptocurrency are the following:

- It is decentralized which means that supply is not determined by a central bank.

- It has no physical form like a dollar bill or coin, and only exists in the network.

- It has no essential value, meaning it can’t be traded and it is not redeemable for another commodity such as gold.

- It is nearly impossible to counterfeit or double spend.

The term cryptocurrency is derived from the encryption techniques used to secure the network. They function using blockchain, a decentralized technology spread across many computers that manages and records transactions with immense security. Without blockchain, cryptocurrency would cease to exist. In simplified terms, the “block” is the digital information, and the “chain” is the public database in which it is stored. They are like a spreadsheet containing information regarding a transaction. Every transaction generates a hash, which is a unique string of letters and numbers created by special algorithms to distinguish one block from another. The computers (also known as nodes) in the network will inspect the transaction and either confirm or reject it. If most of the computers approve the transaction, it is written into a block that joins the chain. Once the new block is added to the blockchain, it becomes public information for anyone to view.

Several popular blockchain-based cryptocurrencies include: Ethereum, Litecoin, and NEO. But the first and most recognized digital currency is Bitcoin. An anonymous entity named Satoshi Nakamoto developed Bitcoin in 2008. According to Coinmarketcap.com, there are now thousands of different ones being traded publicly, but Bitcoin remains the single most well-known cryptocurrency to date. So, what is it exactly? Simplified, Bitcoin is like a computer file that is stored in a ‘digital wallet’ app on either a smartphone or computer. You can transfer Bitcoins to your wallet or to other people like you can with real money. However, unlike money you send through your bank or a digital payment service, the transfer goes to a network of computers which confirm your transaction (as explained above). Moreover, cryptocurrencies like Bitcoin are created through a process called mining. This is not the same as mining for gold. This process involves powerful computers solving complicated problems.

Miners are a crucial tool for cryptocurrencies. Without them, transactions would not be verified, and users would not be able to make payments. Miners like Canaan Avalon 1066 and 1047 are remarkable, sophisticated machines designed to mine blocks. Their roles are to secure the network and process every Bitcoin transaction.

For some, the paper dollar is outdated. Cryptocurrency has emerged as the more progressive and secure medium of exchange, though many people have yet to fully convert to the digital eco-system. Nonetheless, since its inception, the debate to shift to cryptocurrency has advanced. Some of the arguments for the digital dollar and against traditional government-based money include:

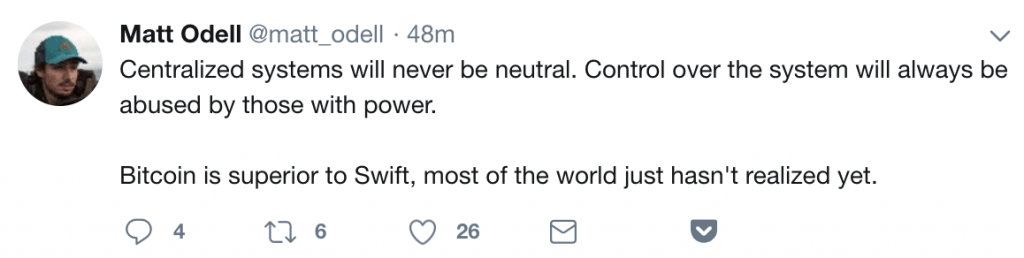

- Overturn corruption: through traditional government-based money, we are giving all our power to one centralized entity to control how it is used and moved. It aims to resolve the issue of absolute power by dispensing power among many people rather than one.

- Eliminate extreme money printing.

- Return absolute power: All assets are transferred to the government when you die without having a legal will in place or having owned a business. With cryptocurrencies, you and only you have access to your funds.

- Eliminate the middleman: Whenever you make a payment or transfer, the middleman (your bank or digital payment service) will take a cut. With cryptocurrencies, all the network members in the blockchain are the middleman.

- Serve the unbanked: A large sector of the world has no access to payment systems like banks. With cryptocurrency, the spread of digital commerce around the globe will enable anyone with a mobile phone to begin making payments.

Globally, the economy continues to move toward a digital eco-system. Everything from money transfers to investments, the world is going paperless. Cryptocurrency has become the most promising addition to the digital payment sector. Blokforge is proud to be a part of the economic progression by providing state-of-the-art miners for mining Bitcoin cryptocurrencies. Additionally, Blokforge is currently working to develop nodes. These are computers in the network that communicate with each other to transmit information.

“Swift is an enforcement arm of the U.S. government,”

“Swift is an enforcement arm of the U.S. government,”