On Wednesday Trueusd, a stablecoin designed to be pegged to the US dollar, experienced a sudden bump in price after Binance announced support. The news caused Trueusd (TUSD) to rise by an unprecedented 40% before eventually subsiding. Trust Token, the coin’s developers, have now explained to news.Bitcoin.com how this sequence of events came to be.

Also read: “Stablecoin” Trueusd Pumps After Binance Listing

Trueusd and the Moon Mission That Wasn’t Meant to Be

As reported on Thursday, TUSD pumped to $1.39 off the back of news that Binance would be listing the supposed stablecoin. Binance has since postponed its listing of the token, pushing the event back by a few days “to prepare for sufficient liquidity”. Trust Token, for its part, has responded to the incident in a blogpost, writing:

TrueUSD saw a large, sudden increase in demand after Binance first announced that they are listing TUSD. We believe that bots (and some misinformed traders) purchased TrueUSD as soon as the announcement was made.

The post continues: “Generally, our policy is that “redeemability leads to stability.” The value of a TrueUSD token is that it can be redeemed for one US dollar. There will only be as many tokens in circulation as there are dollars in the escrow account to collateralize the tokens. In the long run, this feature precedes price stability, since the price will return to $1.00 (as it did today) as long as the token continues to be redeemable.”

Trust Is Earned

Assuaging concerns that TUSD could dip discernibly below $1, Rafael Cosman said:

Price stability is maintained by market-making incentives. Today, market-makers buy TrueUSD for $1.00 directly from the bank, anticipating that if the price hits even $1.01 they can arbitrage some profit. The opportunity for redemption incentivizes market-makers to keep at $1.00 and not below: if the price was to dip to $0.99, then market-makers could buy it and redeem it for $1.00. Market-makers would quickly scoop in and buy all the “sell” orders for below $1.00 until none were left and the price returned to $1.00.

Bot or Not?

Stablecoins are still highly experimental at this stage, and while some “stable bears” believe perfect dollar parity will never be reached, others are confident that anomalies such as that which befell TUSD will be ironed out in time. As Trust Token acknowledged, even “the most stable of stablecoins will occasionally experience variance.”

Do you think occasional volatility is inevitable with stablecoins? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

A 51% attack, also known as a majority attack, refers to a situation in which a single miner or group of miners control the majority of the network hashrate. If attained, this would enable a bad actor to censor and reverse transactions, allowing them to double spend coins. One of bitcoin’s greatest attributes is its immunity to attacks, be they governmental or technological. With over 31 exahash now concentrated on the bitcoin network, launching a 51% attack would be virtually impossible. And yet the very act of contemplating such an event is critical in mitigating the likelihood of it ever occurring.

A 51% attack, also known as a majority attack, refers to a situation in which a single miner or group of miners control the majority of the network hashrate. If attained, this would enable a bad actor to censor and reverse transactions, allowing them to double spend coins. One of bitcoin’s greatest attributes is its immunity to attacks, be they governmental or technological. With over 31 exahash now concentrated on the bitcoin network, launching a 51% attack would be virtually impossible. And yet the very act of contemplating such an event is critical in mitigating the likelihood of it ever occurring.

Whatever way you slice it, a 51% attack on bitcoin isn’t just improbable – it makes zero sense for the attacker. Just because the cryptocurrency seems safe from mining attacks for now doesn’t mean it’s impervious to attack however. In a

Whatever way you slice it, a 51% attack on bitcoin isn’t just improbable – it makes zero sense for the attacker. Just because the cryptocurrency seems safe from mining attacks for now doesn’t mean it’s impervious to attack however. In a

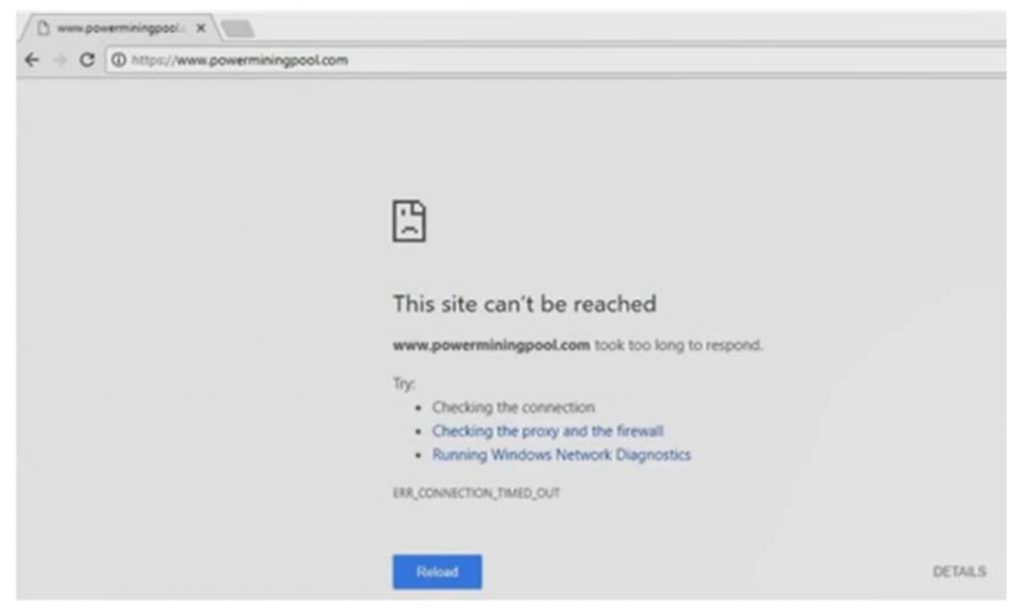

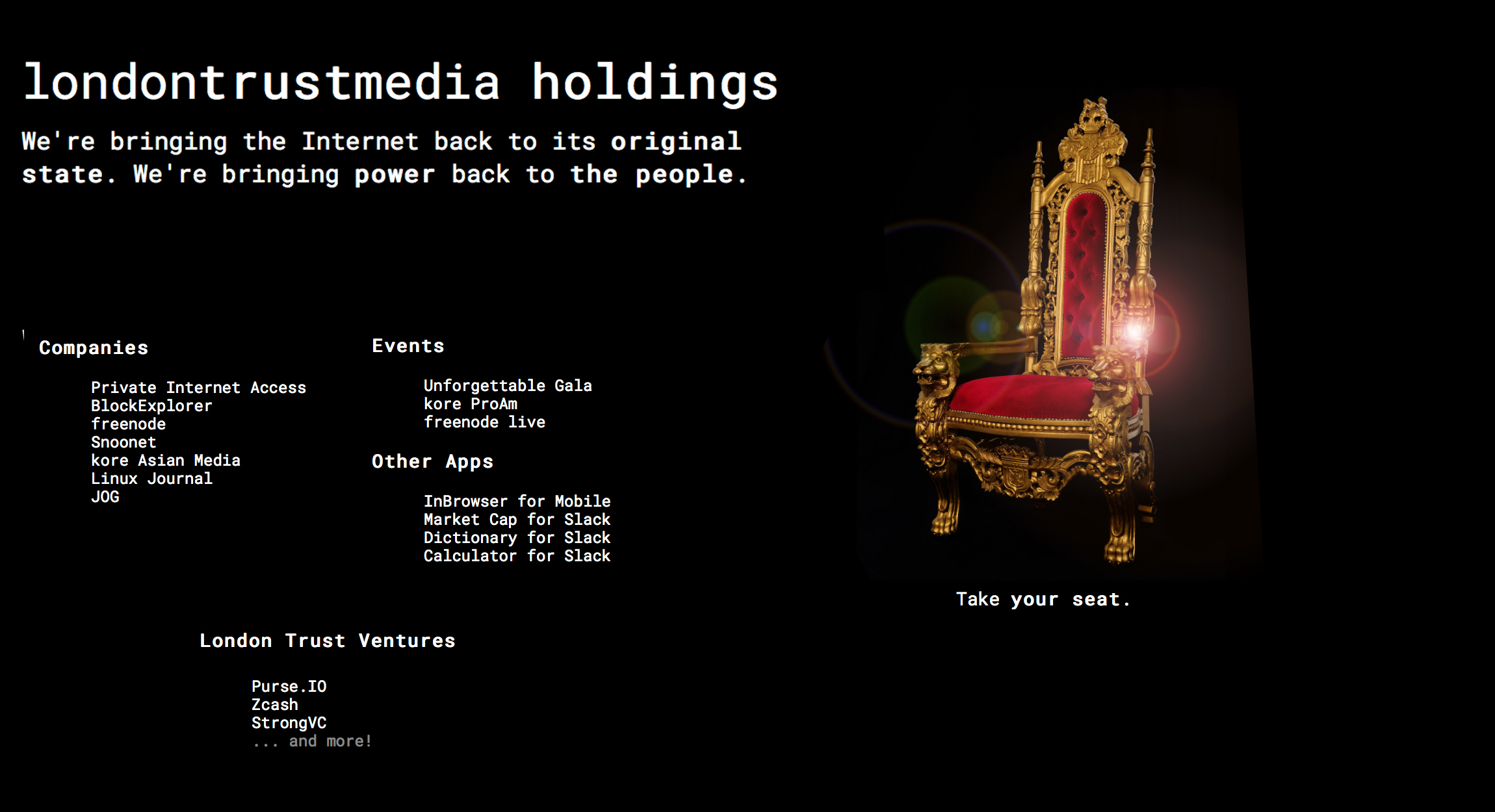

The order mandates the company and any person, employee, officer, director, entity, or independent contractor under its direction or control to permanently cease and desist from selling securities in the state until the security is registered or exempt.

The order mandates the company and any person, employee, officer, director, entity, or independent contractor under its direction or control to permanently cease and desist from selling securities in the state until the security is registered or exempt.

PMP also offers mining pool shares to investors to mine on their behalf. “Investors who purchase mining pool shares must first purchase bitcoin with their fiat currency, such as the U.S. Dollar or Euro,” the order detailed. “Next, PMP directs investors to deposit their bitcoin into PMP’s bitcoin wallet in order to set up an account on the PMP website.” The company then claims to mine cryptocurrencies on investors’ behalf and purported to pay investors the fiat value of the coins mined.

PMP also offers mining pool shares to investors to mine on their behalf. “Investors who purchase mining pool shares must first purchase bitcoin with their fiat currency, such as the U.S. Dollar or Euro,” the order detailed. “Next, PMP directs investors to deposit their bitcoin into PMP’s bitcoin wallet in order to set up an account on the PMP website.” The company then claims to mine cryptocurrencies on investors’ behalf and purported to pay investors the fiat value of the coins mined.

Yahoo! Japan Corporation (TYO: 4689) announced on Friday that it is entering the cryptocurrency space. The company expects to launch an “easy-to-use exchange” for cryptocurrencies in the fall of this year, Nikkei elaborated.

Yahoo! Japan Corporation (TYO: 4689) announced on Friday that it is entering the cryptocurrency space. The company expects to launch an “easy-to-use exchange” for cryptocurrencies in the fall of this year, Nikkei elaborated. Through its wholly owned subsidiary Z Corporation, Yahoo! Japan confirmed the purchase of a 40 percent stake in a crypto exchange called Bitarg Exchange Tokyo Co. Ltd. A person familiar with the matter said that the deal is likely to “total 2 billion to 3 billion yen ($18.6 million to $27.9 million),” Reuters reported. The remaining 60% is still owned by CMD Lab, the parent company of Bitarg.

Through its wholly owned subsidiary Z Corporation, Yahoo! Japan confirmed the purchase of a 40 percent stake in a crypto exchange called Bitarg Exchange Tokyo Co. Ltd. A person familiar with the matter said that the deal is likely to “total 2 billion to 3 billion yen ($18.6 million to $27.9 million),” Reuters reported. The remaining 60% is still owned by CMD Lab, the parent company of Bitarg. Bitarg was established in May of last year. However, the exchange temporarily suspended its service in August 2017, according to Business Insider Japan. The company

Bitarg was established in May of last year. However, the exchange temporarily suspended its service in August 2017, according to Business Insider Japan. The company

The South African Reserve Bank (SARB) has set up a team to monitor fintech developments and assist its efforts to finalize the regulatory regime for cryptocurrencies. Representatives of the private sector have proposed the creation of a Self-regulatory Organization (SRO). While banking falls within the central bank’s jurisdiction, cryptos are not suited to traditional centralized supervision, said a legal expert familiar with the matter.

The South African Reserve Bank (SARB) has set up a team to monitor fintech developments and assist its efforts to finalize the regulatory regime for cryptocurrencies. Representatives of the private sector have proposed the creation of a Self-regulatory Organization (SRO). While banking falls within the central bank’s jurisdiction, cryptos are not suited to traditional centralized supervision, said a legal expert familiar with the matter. In December, the South African Revenue Service announced it was exploring ways to tax bitcoin trading, as

In December, the South African Revenue Service announced it was exploring ways to tax bitcoin trading, as