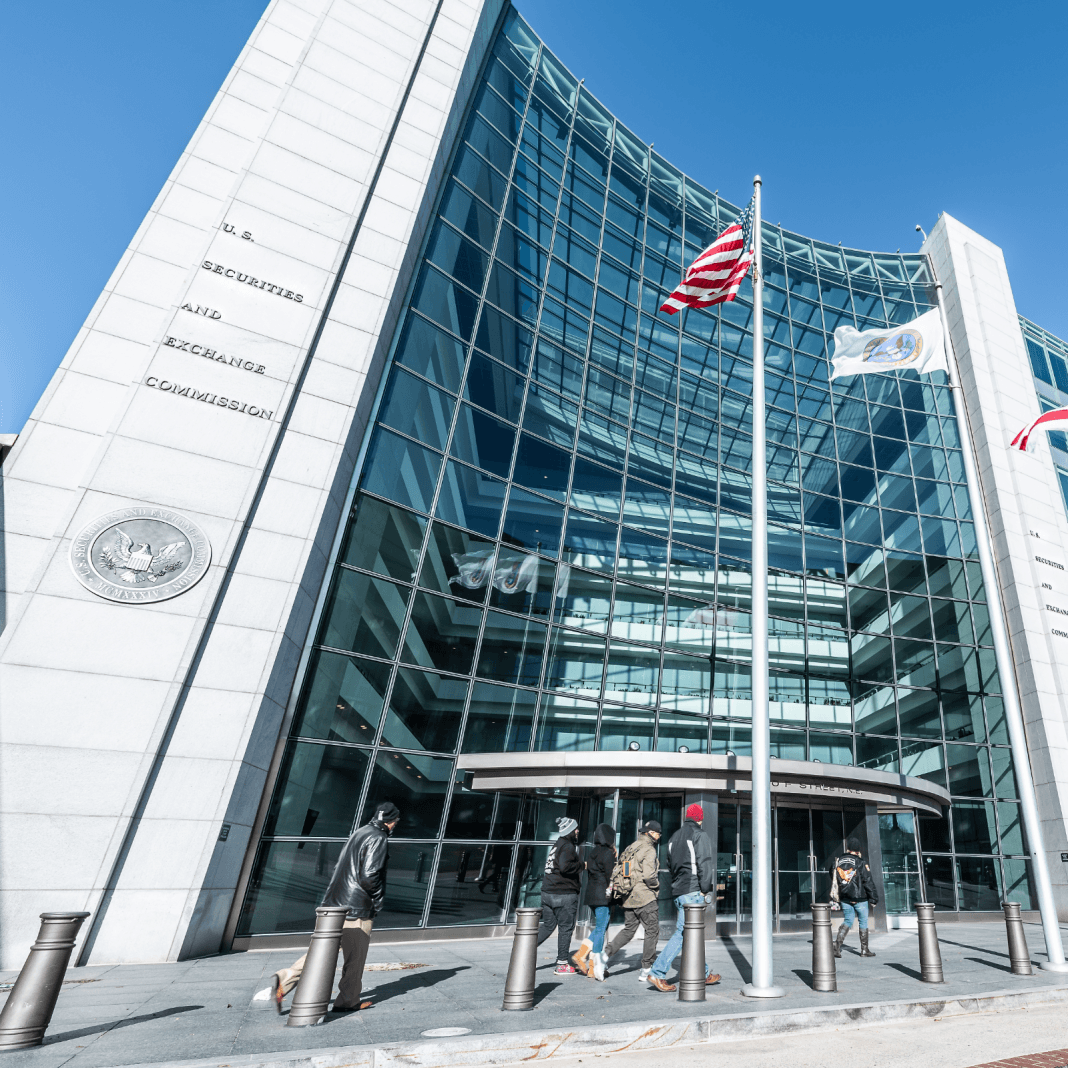

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on the Vaneck Solidx bitcoin exchange-traded fund (ETF), which will trade on Cboe BZX Exchange. The SEC has received more than 1,600 comments and will make a decision by February next year.

Also read: Indian Supreme Court Moves Crypto Hearing, Community Calls for Positive Regulations

New Decision Date

Cboe BZX Exchange filed this proposed rule change on Jun. 20 and, on Sept. 20, the SEC instituted proceedings to make a decision on it. The SEC wrote in its Thursday’s announcement:

The commission, pursuant to Section 19(b)(2) of the [Securities Exchange] Act, designates February 27, 2019, as the date by which the Commission shall either approve or disapprove the proposed rule change.

This proposed rule change was published for notice and comment in the Federal Register on July 2. “February 27, 2019, is 240 days from that date,” the commission wrote.

The SEC also revealed:

As of December 6, 2018, the commission has received more than 1,600 comments on the proposed rule change.

Meeting With SEC

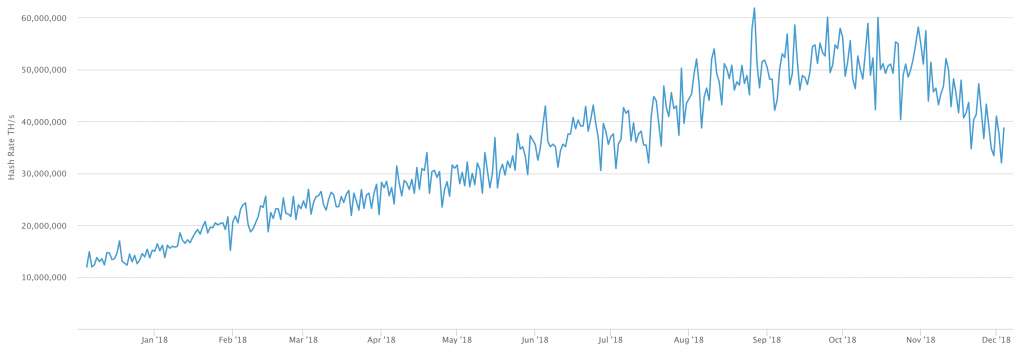

In its presentation submitted to the SEC, Solidx wrote that the “futures markets [for bitcoin] perform a valuable role in price discovery,” adding that “the empirical evidence indicates that the spot and futures prices are cointegrated … this is evidence of a well-functioning capital market.”

When compared to the dry bulk shipping market there is no question that the bitcoin futures market is a significant, regulated market.

Recently, SEC Chairman Jay Clayton spoke about key upgrades he needed to see in cryptocurrency markets before he is comfortable with a bitcoin ETF.

Do you think the SEC will approve this bitcoin ETF in February next year? Let us know in the comments section below.

Images courtesy of Shutterstock, Cboe, Van Eck Securities Corp., Solidx Management Llc.

Need to calculate your bitcoin holdings? Check our tools section.

Christinat told the

Christinat told the  Christinat claimed that Nasdaq remains committed to ensuring the launch of bitcoin futures, emphasizing the company’s long-term perspective on the cryptocurrency industry.

Christinat claimed that Nasdaq remains committed to ensuring the launch of bitcoin futures, emphasizing the company’s long-term perspective on the cryptocurrency industry.

“Yeah, Bitcoin was good in its day, but it’s old tech, bro. It’s all about Blockchain 3.0 now. No one’s gonna use a slow chain that can’t scale and has no governance. It’s all about DAG/DPoS/BFT now.”

“Yeah, Bitcoin was good in its day, but it’s old tech, bro. It’s all about Blockchain 3.0 now. No one’s gonna use a slow chain that can’t scale and has no governance. It’s all about DAG/DPoS/BFT now.”