Electrum developers have confirmed reports of an attack against the popular cryptocurrency wallet. Also covered in The Daily, Huobi Derivative Market’s daily trading volume has reached $1 billion, and one of the founders of Brazil’s leading crypto exchange Foxbit has died in a car crash.

Also read: UFC 232 to Have Official Crypto Partner, 5% of Israelis Use Bitcoin

Electrum Developers Scramble to Stop Phishing Attack

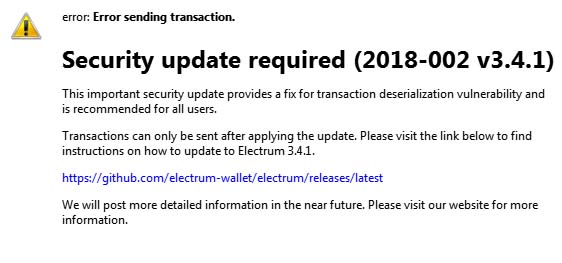

The attack, which began about a week ago, has been conducted through malicious servers. When asked to broadcast a transaction through a legitimate Electrum wallet, these servers reply with an error message, directing users to download a fake ‘security update’ from an unauthorized Github repository.

At startup, the malicious software asks users for a two-factor authentication code, an unusual request as the 2FA codes are needed only when sending funds. The app then uses the code to transfer the stolen digital cash to addresses controlled by the attacker.

Electrum is one of the most popular cryptocurrency wallets with support for major coins such as bitcoin core, bitcoin cash, litecoin, and others. According to a report by Zdnet, the unknown hacker or hackers have so far managed to misappropriate over 200 BTC.

Electrum developers released an update, version 3.3.2, after they were notified of the attack. However, they admitted in a blog post that “This is not a true fix, but the more proper fix of using error codes would entail upgrading the whole federated server ecosystem.” Gitub admins have also taken down the attackers’ repository.

In January of this year, Electrum issued an emergency patch for another bug. The vulnerability exposed passwords allowing websites hosting the wallets to potentially steal cryptocurrency belonging to their users.

Huobi DM’s Daily Trading Volume Surpasses $1 Billion

This just goes to show the market demand for more sophisticated crypto trading tools, particularly those that allow traders to control risks in volatile markets. Huobi DM is a priority for us and we will continue to enhance it over the coming months.

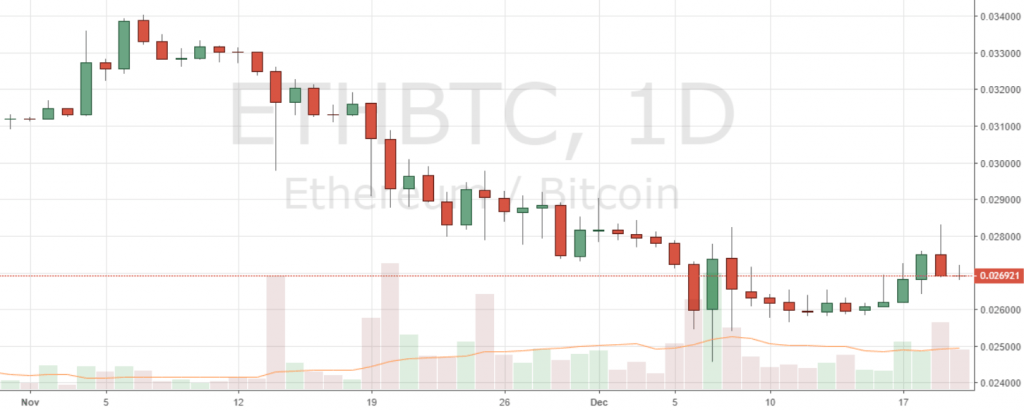

The cryptocurrency contract trading feature offered by Huobi Derivative Market allows users to buy or sell bitcoin core (BTC) and ethereum (ETH) at predetermined prices and specified times in the future. That provides traders with a number of options such as arbitrage, speculation, and hedging. Huobi also plans to offer support for more cryptocurrencies, with EOS contracts already scheduled to go live on Friday.

Foxbit Co-Founder Gustavo Schiavon Dies in a Car Crash

Schiavon established Foxbit in 2014 with three other partners – João Canhada, Marcos Henrique and Felipe Trovão. In the following years, it became Brazil’s largest digital asset trading platform. This past March, the exchange lost to hackers 1 million Brazilian real (approximately $260,000), however, restored customers’ balances with the company’s own reserves.

This year Foxbit was also involved in a lawsuit against a commercial bank that closed its account citing concerns over money laundering. Without presenting evidence in court, the bank claimed it had the right to shut down accounts which it determined to be risky, which was later confirmed by Brazil’s judiciary.

What are your thoughts on today’s news tidbits? Tell us in the comments section.

Images courtesy of Shutterstock, Electrum, Foxbit.

Make sure you do not miss any important Bitcoin-related news! Follow our news feed any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll down to the bottom of this page to subscribe). We’ve got daily, weekly and quarterly summaries in newsletter form. Bitcoin never sleeps. Neither do we.

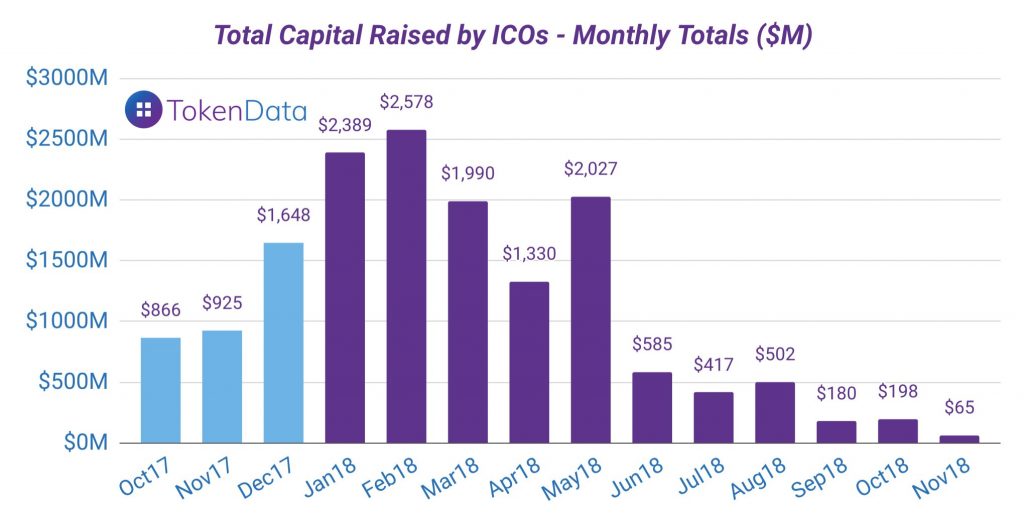

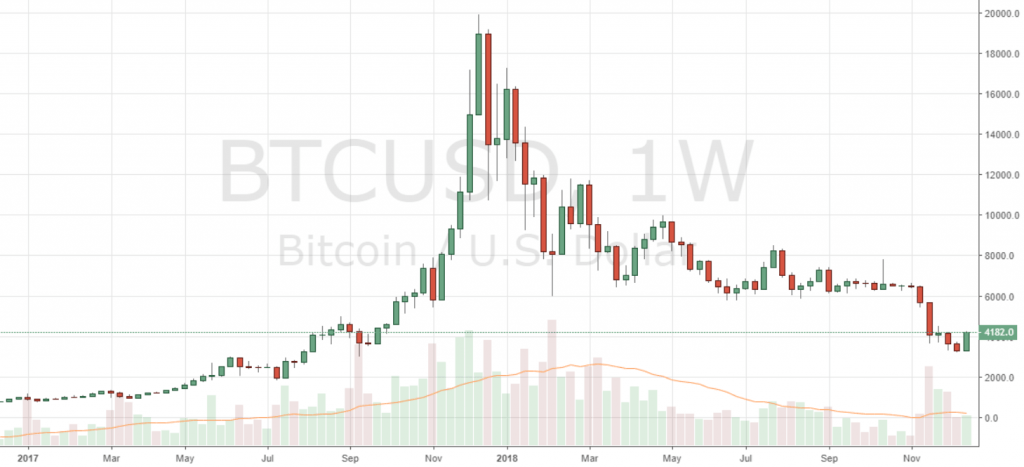

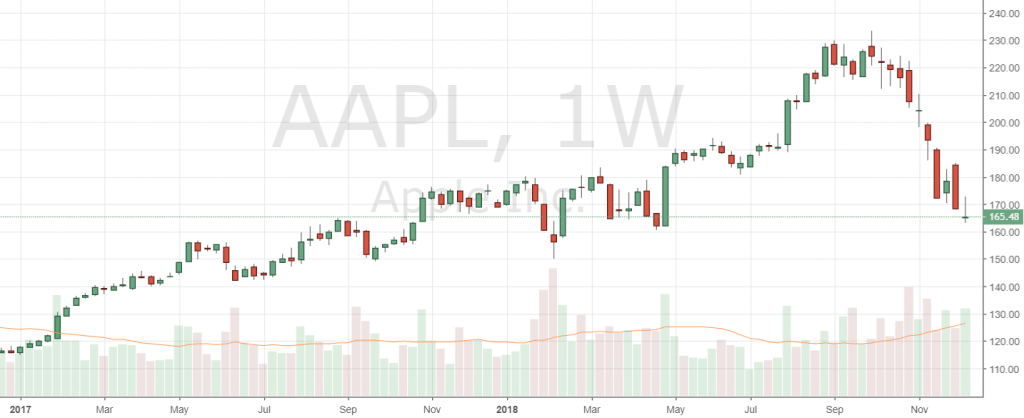

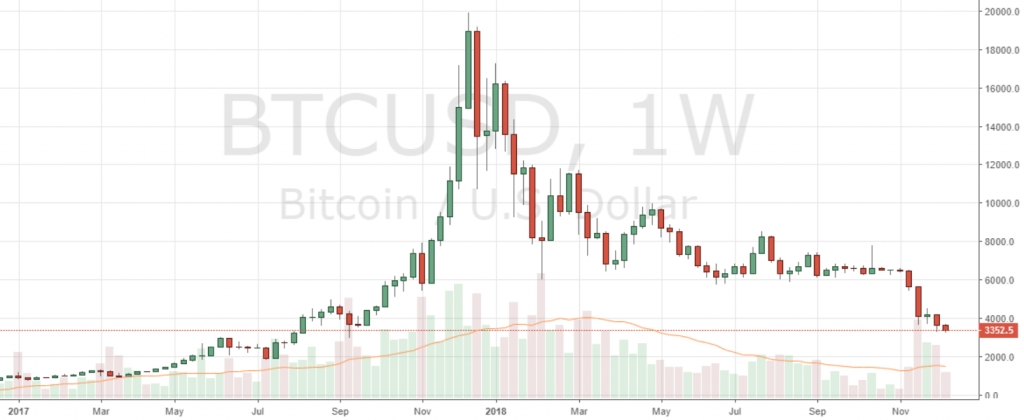

This time last year, all kinds of bold predictions were being issued for what 2018 would hold for the crypto space. In the event, the biggest trend of the year was one which few futurologists foresaw – stablecoins. 2018 will go down as the year the markets went south and ICOs died off, leaving a new wave of digital assets to shine – dollar-pegged stablecoins.

This time last year, all kinds of bold predictions were being issued for what 2018 would hold for the crypto space. In the event, the biggest trend of the year was one which few futurologists foresaw – stablecoins. 2018 will go down as the year the markets went south and ICOs died off, leaving a new wave of digital assets to shine – dollar-pegged stablecoins. With the Mimblewimble-powered

With the Mimblewimble-powered

While security token projects are poised to launch in proactive territories like Malta and Gibraltar, where regulatory frameworks have been drawn up, slower progress is expected in the U.S., where fundraising options are limited. There, the SEC will likely deem most ICOs to be issuing securities. American crypto-based projects are no closer to being granted Reg A+ approval to launch an STO, despite some, such as Gab, having filed the paperwork over a year ago.

While security token projects are poised to launch in proactive territories like Malta and Gibraltar, where regulatory frameworks have been drawn up, slower progress is expected in the U.S., where fundraising options are limited. There, the SEC will likely deem most ICOs to be issuing securities. American crypto-based projects are no closer to being granted Reg A+ approval to launch an STO, despite some, such as Gab, having filed the paperwork over a year ago. Crypto debt markets and credit networks will be bolstered by the growth of projects like

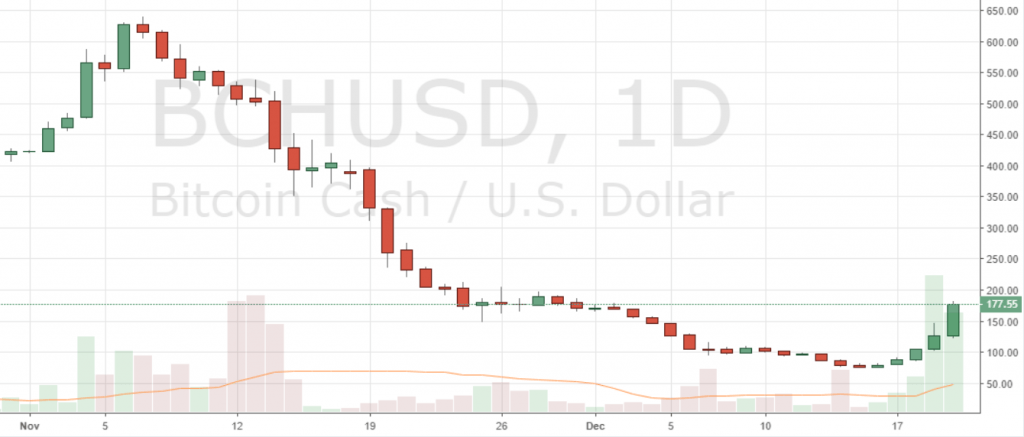

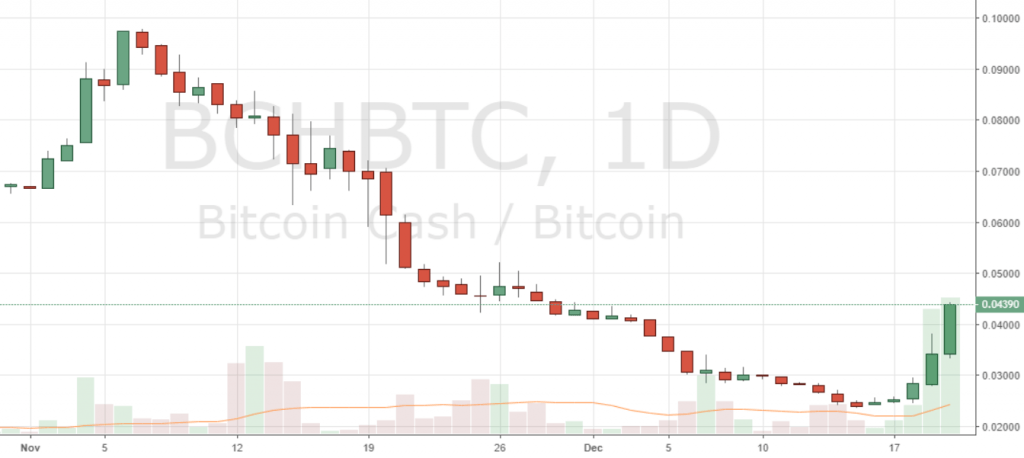

Crypto debt markets and credit networks will be bolstered by the growth of projects like  The Bitcoin Cash community will continue to find new ways to spend and receive peer-to-peer cash, while the BTC brigade will have optimism that 2019 will finally be the year when the Lightning Network proves its suitability for something more than purchasing stickers. Custodial services for institutional investors will improve, bringing new money into the crypto space (but probably not propelling crypto assets to new highs). NYSE’s Bakkt will launch, bringing physical BTC futures contracts, and there’s an outside bet the SEC might approve a bitcoin ETF.

The Bitcoin Cash community will continue to find new ways to spend and receive peer-to-peer cash, while the BTC brigade will have optimism that 2019 will finally be the year when the Lightning Network proves its suitability for something more than purchasing stickers. Custodial services for institutional investors will improve, bringing new money into the crypto space (but probably not propelling crypto assets to new highs). NYSE’s Bakkt will launch, bringing physical BTC futures contracts, and there’s an outside bet the SEC might approve a bitcoin ETF.

Open Finance Network (OFN), a security token trading platform regulated in the U.S., announced it’s transitioning from beta to full trading functionality. According to a blog post on Medium, one of the security tokens available to trade at launch is Blockchain Capital (BCAP). Blockchain Capital is a tokenized venture capital fund focused on digital assets. OFN notes that this is a compliant security token offering.

Open Finance Network (OFN), a security token trading platform regulated in the U.S., announced it’s transitioning from beta to full trading functionality. According to a blog post on Medium, one of the security tokens available to trade at launch is Blockchain Capital (BCAP). Blockchain Capital is a tokenized venture capital fund focused on digital assets. OFN notes that this is a compliant security token offering. Digital asset exchange and crypto wallet provider

Digital asset exchange and crypto wallet provider

Earlier this year, the Pridnestrovian Moldavian Republic (

Earlier this year, the Pridnestrovian Moldavian Republic ( The largest producer of electricity in the region is the Russian-owned

The largest producer of electricity in the region is the Russian-owned

The

The  The average cost of remittance for sending $200 is as high as $36 between South Africa and Botswana, for example, showing significant scope for cryptocurrencies to provide a low-cost alternative. But BTC’s use cases don’t end there. “In the past, when high inflation took hold in a person’s country, there was little that they could do except watch as their purchasing power evaporated,” continues the report. Now, “any person with internet access has the option to insulate themselves from local currency risk by switching to [BTC]. Essentially, bitcoin can offer a check on government power and policy while providing a vital safe haven for people from all around the world.”

The average cost of remittance for sending $200 is as high as $36 between South Africa and Botswana, for example, showing significant scope for cryptocurrencies to provide a low-cost alternative. But BTC’s use cases don’t end there. “In the past, when high inflation took hold in a person’s country, there was little that they could do except watch as their purchasing power evaporated,” continues the report. Now, “any person with internet access has the option to insulate themselves from local currency risk by switching to [BTC]. Essentially, bitcoin can offer a check on government power and policy while providing a vital safe haven for people from all around the world.”