Joseph Christinat, the vice president of Nasdaq’s media team, has confirmed that the exchange will soon launch bitcoin futures. In a recent interview with a newspaper in the U.K., Christinat revealed that the platform plans to start offering bitcoin futures contracts within the first half of 2019.

Also Read: Chilean Court Rules in Favor of Closing Bank Accounts of Crypto Exchange Orionx

Nasdaq Waiting for ‘Go-Ahead’ From CFTC

“Bitcoin Futures will be listed and it should launch in the first half of next year,” Christinat said, adding that Nasdaq is currently “waiting for the go-ahead” from the U.S. Commodity Futures Trading Commission (CFTC). “There’s been enough work put into this to make that academic. We’ve seen plenty of speculation and rumors about what we might be doing … so, here you go — we’re doing this, and it’s happening.”

Exchange Unfazed by Cryptocurrency Bear Market

“We got into the blockchain game five years ago,” Christinat stated. “When the technology first popped up we just leant out of the window and shouted ‘hey come over here’ right at it.”

Christinat also said Nasdaq has devoted a significant amount of resources toward launching bitcoin futures. “We’ve put a hell of a lot of money and energy into delivering the ability to do this and we’ve been all over it for a long time — way before the market went into turmoil, and that will not affect the timing of this in any way. No. Period. We’re doing this no matter what.”

Do you think we will see the launch of Nasdaq’s bitcoin futures before the second half of 2019? Share your thoughts in the comments section below.

Images courtesy of Shutterstock

The Bitcoin universe is vast. So is Bitcoin.com. Check our Wiki, where you can learn everything you were afraid to ask. Or read our news coverage to stay up to date on the latest. Or delve into statistics on our helpful tools page.

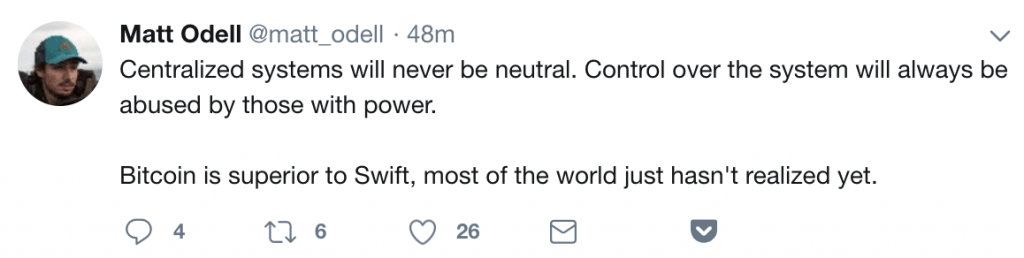

“Swift is an enforcement arm of the U.S. government,”

“Swift is an enforcement arm of the U.S. government,”